Where Accountants’ Creativity Can Lead

As the pandemic recession continues to hover over, companies have begun exploring the possibilities of creative accounting practices. While some manage to both use them and provide a detailed explanation of the manipulations, others choose to hoodwink their investors. However, there are also companies who have become victims of their own creativity.

Creative accounting practices can be as inventive and ingenious as bookkeepers manage to make them. However, finance experts and managers need to know accounting rules and practices to capitalize on the loopholes effectively and ethically, corroborating that short-term fixes provide long-term benefits.

Creative accounting can often result in novel, sometimes dubious metrics used to report earnings. One of the more recent ones, coined jokingly by Twitter users, is EBITDAC, or “earnings before COVID-19,” given the sharp hit many companies have taken this quarter due to the pandemic. (Source: MarketWatch)

The practice of creative accounting goes as far back as Hollywood accounting in the second half of the 20th century. Since then, using lawful applications of the finance laws and regulations employed to deceive the audience about the available wealth of the "preparer" has been named creative accounting. The practice is usually used to improve market expectations of the business's wealth, enhance work, exercise the right for a bonus-related pay, improve one's bargaining power before an M&A deal, or even cover up fraudulent activity. All the actions associated with deceiving stakeholders are closely monitored; the law, as a result, gets updated when dangerous pathways to avoid legal compliance are used to harm or mislead.

Today, during the economic downturn, companies fear negative market perception. To correct the pandemic's impact, many have resorted to unethical yet lawful ways of reporting their profit while some, like Verizon and Boston Beer Co., have managed to stay honest and open about their manipulations.

A telecoms conglomerate, Verizon Communications Inc. has not yet returned to the pre-pandemic stock price. However, since its lowest figure in March, it has been steadily on the rise. The company has openly disclosed that the recent economic downturn decreased its earnings per share (profit divided by the number of outstanding shares) by 4%. The company claims that its cause lies in the decision not to expect money for the services it has credited to its clients. Being open and transparent with its adjustments and hardship while simultaneously helping its customers by being socially responsible has helped Verizon grow back its wealth and maintain its dominant brand perception.

Similarly, The Boston Beer Company, Inc. (SAM), a malt beverages business, chooses to remain transparent when discussing the impact of a pandemic on its profit. After realizing that there was a $10 million revenue decline in April, the company decided to show a precise breakdown of its adjustment process. Despite the reported loss, since April, the stakeholders' perception seemed to have strengthened due to the honesty of the company's staff and the help of the consumers' stockpiling, bringing the stock price above the pandemic levels.

The two examples from different industries may not be generalizable or representative of the entire market. However, they do set an example of how one can remain honest and transparent about adjusting the revenues and improving the tools for a more beneficial market perception, making sure that unethical decisions of the finance experts do not fool inexperienced investors.

Unlike Verizon and Boston Beer Co., some companies opt out to using non-standardized measures and decide not to disclose in detail their revenue adjustment processes.

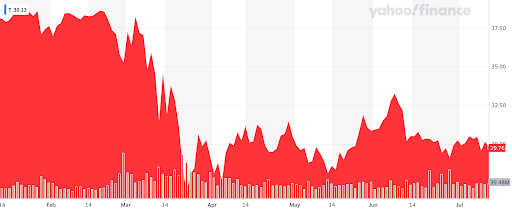

AT&T’s stock price for the past six month has shown a rapid fall of its value in the mid-March and a slow recovery until now. (Source: Yahoo! Finance)

In the accounting world, a set of rules that guide the creation of financial reports called GAAP binds companies to use only standardized measures as leading since non-standardized measures have the potential of establishing significant disparity in valuations and misled inexperienced investors. However, GAAP does not prohibit the use of non-standardized measures, and Uber, together with AT&T, seems to be using such permission to the fullest extent possible.

Due to the use of non-standardized metrics, Uber has drawn too much attention from the U.S. Securities and Exchange Commission (SEC). It also continues to experience a falling stock price. AT&T, on the other hand, failed to provide a thorough breakdown of its adjusted earnings. The market, fearing the lack of lucidity, has paid back with the slowest —among all the companies discussed above— recovery since the lowest figure in March.

Remaining within the legitimate frames, Uber and AT&T nevertheless provide far too little explanation and clarity on their accounting practices, making not only the investors more cautious but their auditors and the SEC as well. It is vital to consider that long and tedious audits not only lead to a damaged public perception and market avoidance but can also cause substantial fines for accounting firms. Such measures can further damage the financial position of a business or even bring it to permanent termination. Wirecard's experience has shown how these can be destructive.

Markus Braun, former Chief Executive Officer of Wirecard AG. (Source: CNBC)

While the previously discussed cases try their best to adhere to the GAAP guidelines (disregarding their ethicality), the German payment firm Wirecard has probably forgotten about the rules and failed to take care of the 2 billion euros ($2.24 billion) in loans. After a tedious audit and inspection, the April report of KPMG (a global network of professional firms providing audit, tax, and advisory services) concluded that it could not verify the genuineness of "the lion's share" of Wirecard profits reported from 2016 to 2018. After a criminal investigation and the arrest of Markus Braun, the former CEO, Wirecard filed for insolvency.

The story of Wirecard tells the market the narrative of the necessity to be transparent and honest. By engaging with one lie after the other, the firm could not keep up and explain all the fraudulent practices. Apart from hurting its image and reputation, it has also damaged the lives and stability of thousands of U.K. consumers who can not access their funds after the collapse. Its investors were also misled by Mr. Braun's attempts to make Wirecard's finances look healthy. The firms' journey is reminiscent of the deceptive nature of creative accounting and urges everyone to stay transparent and honest, no matter how important the short term fix may seem.

In essence, the pandemic has provided a unique challenge for the economy in 2020. It is no secret that the road towards recovery is long and that the losses are unavoidable. Businesses should always keep in mind that investors are aware of the hardship and that the effects are widespread. It is not a crime to engage with creative accounting to provide a short-term fix whenever an unexpected hit damages the financial situation to ensure that investors do not misinterpret a temporary change. However, all the financials need to be transparent and explained for the sake of ethicality and a continuous healthy recovery from the pandemic.

“It is no secret that the road towards recovery is long and that the losses are unavoidable. Businesses should always keep in mind that investors are aware of the hardship and that the effects are widespread... However, all the financials need to be transparent and explained for the sake of ethicality and a continuous healthy recovery”