The Crossroads of Humans and Machines: Chicago Breakout 2020

This piece was adapted from Breakout participant Joe Dimarino’s work.

Summary

This past week, Business Today brought a group of twenty Princeton students on an all-expenses-paid breakout trip to Chicago. The theme focused on the intersection of man and machine. Students not only learned about the transformation of key industries, but they were also encouraged to explore a wide variety of businesses, including food, finance, sports, and more.

One of the first areas students dove into was finance and its transformation through technology. Students kicked off Day One with an early morning meeting with Alliant Credit Union executives Dave Mooney (CEO) and Al Pitcher (CTO). The conversation quickly delved into the changes observed in retail banking. Once controlling market share through the number of physical branches and locations, retail banks now rely on growing their digital tools. Customers today care more about price, experience, and brand than ever before. The executives emphasized the importance of constantly learning to drive innovation.

In the realm of investments, Halo Investing and Citadel added onto the notion of technology revolutionizing the sector. Both have products that invest using algorithms rather than human traders. While they have similar sector focuses, the difference in size between the two companies gave students food for thought. Halo Investing is a startup, and students were provided some useful career advice: “Think about what you would get into in at a larger firm and if you actually believe in the mission.” On the other end, with over a thousand employees, Citadel still feels like a small team: it is an incredible place to grow an employee’s network and handle large responsibilities immediately on the job.

“Think about what you would get into in at a larger firm and if you actually believe in the mission.”

On our final day, we visited the Chicago Board of Exchanges. Students were introduced to calls and puts, basic options that allow someone to make an investment. As a short intro, a call is a contract to purchase some amount of securities at a set expiration date and price. If the price goes up beyond the price set by the individual in the call, they make money since they are purchasing the stocks at a lower price. Otherwise they lose money since options cost money to exercise. A put would exhibit opposite behavior. Not only does the CBOE manage a countless number of options every day, they provide a volatility index, which fluctuates based on current events. For instance, the market as of late has been more volatile due to the coronavirus outbreak. All of the options trading and volatility tracking are executed through technology too.

While finance is a field strongly impacted by technology, other areas, including marketing, sports, food, and healthcare, are also being reshaped by data. At Digitas, a marketing firm, data is used to tell a story and create campaigns. At the Chicago Cubs and Chicago Fire, the respective baseball and soccer teams for the city, actions by players are driven by sports analytics, as are business decisions. In baseball, a huge shift has occurred in not just measuring outcomes but the decisions behind them. Dan Michelson, CEO of the healthcare data company Strata, spoke about the metaphorical 22 x 22 Rubik’s cube of the healthcare industry and how their product is organizing once absent and disjointed healthcare analytics for providers.

“ Aside from the consumer, businesses are thinking about optimizing food delivery through data, whether it’s determining the best time to deliver fresh food or nailing down the perfect mix of size and variety of different foods in certain stores.”

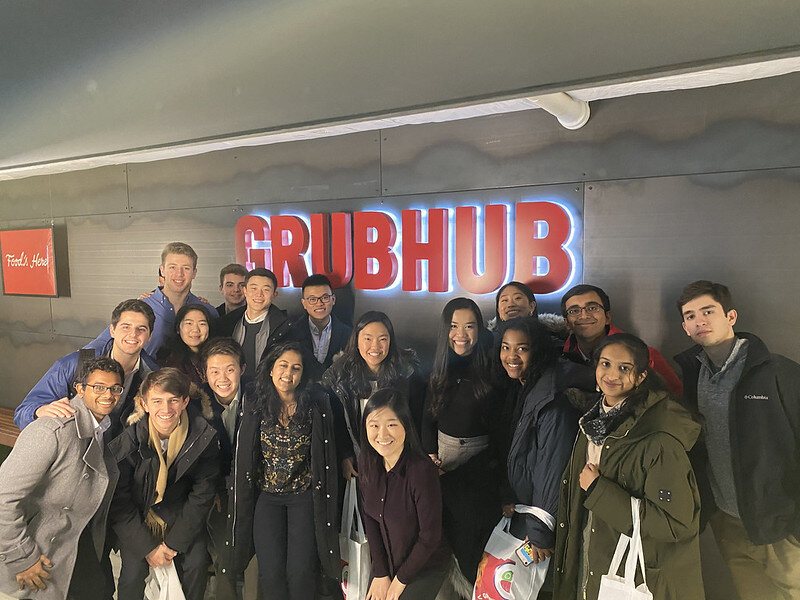

At Kraft-Heinz, Breakout participants learned how consumer data is leveraged to support e-commerce for the one billion dollar brand. Aside from the consumer, businesses are thinking about optimizing food delivery through data, whether it’s determining the best time to deliver fresh food or nailing down the perfect mix of size and variety of different foods in certain stores. The definition of e-commerce itself has evolved into something concerning food pickup at a store, food delivery to the home, or the genesis of purchasing online. Grubhub conveyed a similar tone in speaking to the heterogeneity of the food industry. Once an app that focused on partnerships with small restaurants, they’ve boosted their work in enterprise brands like Taco Bell, creating new challenges of understanding how to manage customization for these bigger companies.

Takeaways

As much as students heard about the changes in different industries, they also received a ton of career advice. We’ll conclude this piece with our top ten pieces of advice and industry insights we heard from this trip:

“Never stop learning. Keep learning for innovation.” — Alliant

“If you’re in finance and you’re not embracing tech, you’re missing the boat.” — Halo Investing

“Digital expectations are so high right now. If you design something poorly, that can truly destroy your business because the world is so interconnected.” — Digitas

“Relationships are critical to success and opportunity.” — Chicago Fire

“Everyone has ownership of the path they take and what they do. Work for something that requires a diversity of challenges and problems.” — Chicago Cubs

“Use the strength and value of your brands to launch yourself forward.” — Kraft Heinz

“Clear communication skills are huge, as are being crisp and concise.” — Citadel

“Focus on a smaller, specific branch in which you can succeed. Don’t spread yourself too thin by trying to get into every aspect of a crowded market.” — Grubhub

“Instead of looking for a job, look for a purpose.” — Strata

“Go to something that catches your eye and build out from there. Find your niche.” — CBOE